Feeling overwhelmed by debt? You’re not alone.

For many Americans, debt is part of life. It can feel impossible to imagine a future without monthly payments or balances hanging over your head. If your bills are starting to feel stressful or hard to manage, the good news is that you still have options. One solution that may be worth exploring is a debt consolidation loan.

What is a Debt Consolidation Loan?

At first, taking out another loan to manage debt might sound counterintuitive, but for many people, it can actually simplify things. A debt consolidation loan combines multiple debts into one new loan with a single monthly payment.

This doesn’t make your debt disappear, but it can make it easier to manage. In many cases, consolidation also comes with better terms, like a lower interest rate, which can help you regain control of your finances and move forward with more confidence.

Benefits of a debt consolidation loan:

- Fewer Payments to Track: Instead of juggling multiple due dates and lenders, you’ll make just one payment each month, making it easier to stay organized and avoid missed payments.

- Potentially Lower Interest Rates: If your current debts have varying (and higher) interest rates, consolidating them into one loan may reduce the overall rate. Just be sure to compare your options before committing.

- A Clearer Path Forward: With everything in one place, it’s easier to see your progress, stay motivated, and potentially pay off your debt faster, saving you money over time.

Potential Risks to Keep in Mind

Debt consolidation can be helpful, but it’s not the right fit for everyone. There are a few things you should consider:

- It Doesn’t Erase Debt: If spending habits or budgeting challenges aren’t addressed, you could end up back in the same situation down the road.

- Collateral May Be Required: Some consolidation loans require an asset, like a car or home, as collateral. This may be different from your existing debts, so it’s important to weigh the risks.

- Lower Payments Aren’t Guaranteed: While consolidation often helps reduce payments, that’s not always the case, especially if the loan terms aren’t favorable.

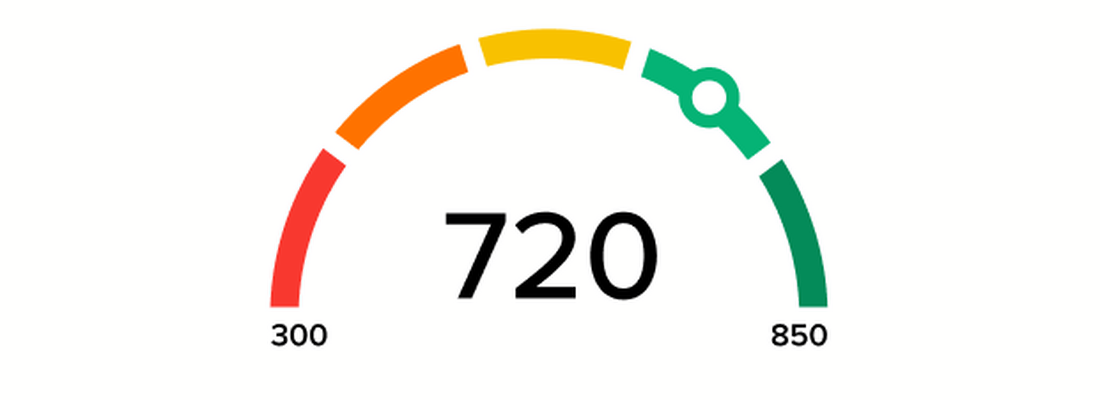

How does a debt consolidation loan affect your credit score?

Applying for a new loan does involve a hard credit inquiry, which may cause a small, temporary dip in your score. However, paying off other balances can lower your credit utilization, which may help your score improve over time as long as payments are made on time.

When should you consider a debt consolidation loan vs. other options?

Before deciding, it’s smart to explore all your options. A debt consolidation loan may make sense if:

- You’re struggling to keep up with multiple monthly payments.

- You have high-interest credit card debt and solid credit.

- You can secure better interest rates or payment terms than what you currently have.

If consolidation doesn’t improve your interest rates or simplify your payments, it may not be the best choice for you.

How Credit Sense can help

As an Availa Bank customer, you get free access to Credit Sense, a credit monitoring and education tool designed to help you understand and improve your financial health.

One standout feature is the debt-to-income (DTI) ratio module, which gives you a quick snapshot of how much of your income goes toward debt. With just two inputs, you’ll see your DTI percentage, a breakdown of your debts, and personalized tips to help lower your ratio.

Credit sense also includes score simulators, goal-setting tools, and ongoing credit monitoring so you can see how different decisions might affect your credit before making them. All of these services are available to you through the bank’s mobile app or online banking.

Debt isn’t something anyone enjoys, but it doesn’t have to define your future. If you’re thinking about a debt consolidation loan, your local Availa banker is ready to help you explore your options and take the next step towards financial peace of mind.