YEAR IN REVIEW —

Community Impact

Our Promise —

The Availa Mission

Our Mission is to empower our team to inspire and enable our clients and the communities we serve to achieve financial success.

-

Our Vision

Availa Bank will operate as one organization while recognizing that our markets and clients are diverse by providing solutions that meet their evolving needs.

Availa Bank will enhance our banking experience by engaging clients in their preferred setting, through their desired delivery channels, to maintain life-long relationships.

Availa Bank will support the growth of our team through a commitment to training, mentoring, and professional development.

Availa Bank will focus on team satisfaction and retention while recognizing and rewarding accomplishments that align with the bank's mission and values.

Availa Bank will strategically balance the objectives of steady growth and consistent earnings with sound risk management practices, thereby enhancing shareholder value.

-

Our Values

We are owners. Every day, we take the initiative and are accountable - with integrity, ethics, and courage - to make our bank better.

We believe our people make a difference. We build teams by hiring and developing the best talent. We recognize that individual differences and experiences strengthen our teams.

We know client relationships are key. Banking is more than just a series of transactions; it is a partnership with clients to find solutions that will assist with reaching financial success.

We focus on our communities. We are proud to invest in, and contribute to, the communities that we serve.

We strive to be better than yesterday. We seek out, embrace and get (un)comfortable in knowing that if we're not continuously changing, evolving, and improving client and employee experiences - we're falling behind.

Who is Availa Bank —

About Us

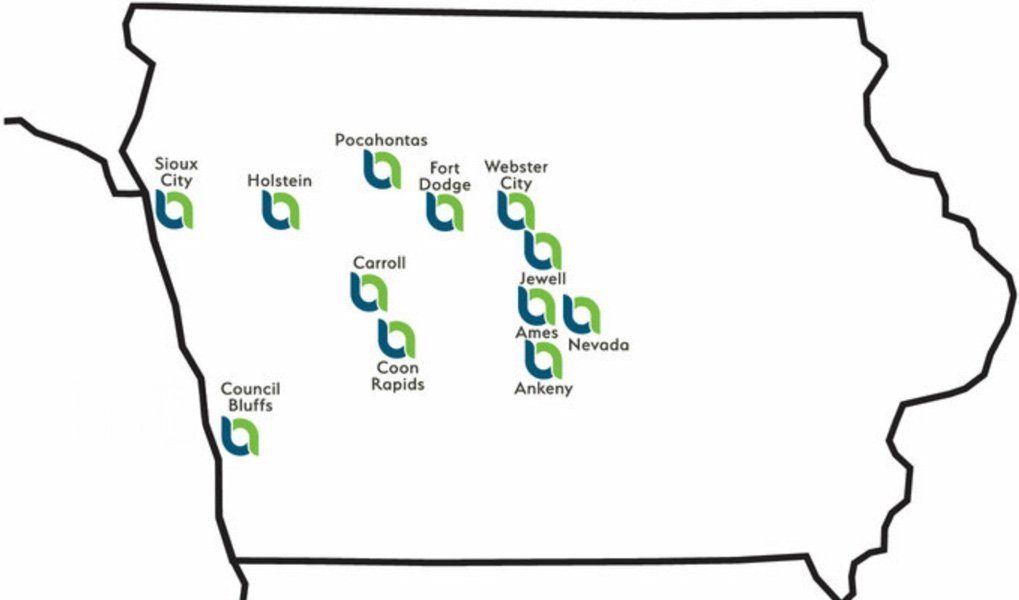

The roots of Availa Bank run deep in the Iowa soil. Since 1870, the bank has been a cornerstone for continued growth across West Central Iowa. Despite a variety of changes, including new names, branch expansions, and technological advances, Availa Bank has stayed true to its roots: providing local service to local communities for over 150 years.

Availa's History1.6 billion

Asset Size

Local people serving local needs —

As a community bank

We don't just care about financial transactions. We care about our communities — and making sure they remain a great place to live and work. Because we are local, we are better equipped to understand the unique needs of the people we serve, offering personalized products and services. You can be sure when you walk into one of our branches, you'll be greeted by a team member who has a genuine interest in your financial future.

By the numbers —

Investing in our Community

We’re proud to invest in the communities we serve, not just financially but with our time as well. Many of our team members are active in nonprofit organizations and boards that serve community needs. Because of these community connections, Availa Bank gives back a portion each year to worthwhile nonprofits and organizations so they can continue improving small towns and communities across Iowa.

-

-

183

Associates

-

8

Board of Directors

-

6

Executive Leadership

-

10

Market Presidents

-

-

656

Community Partnership

40

Board member roles filled in 2023

-

3,634

Volunteer Hours donated to local causes

-

$219,374

Total donations from local branches in 2023

$11,188

Total donations from team members in 2023

-

Availa Foundation

The Availa Foundation is 100% funded by Availa Bank and donations to qualified organizations are all approved by the Foundation's directors. It began as the Carroll County State Foundation in 1966 and has continued the tradition of giving back ever since.

-

Availa Kares

In July of 2018, Availa Bank was approached to be a major funding partner by the Financial Literacy Council of Greater Hamilton County for a new initiative impacting Hamilton County youth. The Availa Kares program is designed to provide funding for 529 College Savings Plans to help the students of Hamilton County further their education upon graduation from high school.

We can help you —

Loans & Grants

Availa Bank is proud to offer a variety of grant programs and loans so that individuals and businesses can reach their financial goals. It's important to us that there is opportunity for entrepreneurship, personal growth, and community development in Iowa and the surrounding states.

-

$983,185

Grant Program Loans

-

$50,000

Grants

-

$1,323,649

FSA Loans

Availa Benefits —

Our people make the difference

- Health insurance

- Dental insurance

- Vision insurance

- Life insurance

- Short term disability insurance

- Long term disability insurance

- Accident insurance

- Critical illness insurance

- Hospital indemnity insurance

- Lifetime benefit insurance (includes long-term care option)

- Cancer protection assurance

- Flexible spending account

- Limited flexible spending account

- Dependent care account

- Paid time off

- Paid holidays and floating holiday pay

- 401(k) (pre-tax and post-tax options)

- Employee Stock Ownership Plan (ESOP)

- Financial benefits including no cost products and services

- Financial education

- Affiliate of Iowa Bankers Association

Employee wellness program —

The "A Team"

The A Team is a health and wellness committee made up of Availa Bank team members. Their mission is to empower their team to inspire and enable their coworkers to achieve their wellness goals. The A Team is made up of 5 subcommittees with different focuses, including Challenges, Book Club, Facebook/Paylocity, Communications, and Growth & Planning. The group started in 2021 and consists of 11 members across the bank's branches.

- Hosted 9 potlucks

- Walked over 6,505 miles

- Completed 520.5 hours of phyisical activity

- Read over 5,537 pages through the “Book Club”

Financial Education —

Outreach

At Availa Bank, we believe the more education we can bring to our communities, the more prepared they will be to make sound financial decisions. We want to be part of the solution in improving financial literacy. Our financial education outreach program is targeted for all ages and stages of life — in every community we serve. Everyone should have access to a financial literacy program to ensure a strong financial future. We host several free, educational events for the public throughout the year, many of which help attendees build practical financial management skills.

In 2022-2023, we spent 309 hours planning and executing these events, reached 8,198 people (of which 1,745 were older adults), and put on 132 events across our branch communities. Here are some ways we're addressing gaps in financial education across the communities we serve.

-

309

hours

-

Planning and executing

-

132

Events

-

8,198

People attended our events

1,745

Of those in attendance, were older adults

-

BizEd4 U

This event is catered toward high school students who have an interest in business. Students are invited to a 1-day event where they work in teams to come up with a product or service that solves a problem or meets a need in the community. Once they create their business plan (with the help of local business professionals and firsthand advice from local entrepreneurs) they must pitch their ideas to a panel of judges who, much like Shark Tank, judge on the quality of the idea, presentation, and realistic implementation. Students benefit from this event by networking with current business owners, learning what it takes to be an entrepreneur, and understanding what resources are available in their community. Current small business owners also benefit by networking with the students that could be part of their future staff or future business partners.

-

AgBiz4 U

Much like BizEd4 U, this event challenges high school students to think like entrepreneurs, except this time the focus is on the agricultural industry. Students involved in ag classes or FFA are invited to this 1-day event where they are tasked with creating a product or service that meets a need or solves a problem in ag. Students are mentored by college students enrolled in ag classes and are judged by a panel of local business professionals. The top three groups receive a prize based on the quality of the idea, presentation, and realistic implementation. This is a great opportunity for students to network with college students, check out options for their future, and be creative.

-

Budget4 U

Many people — from teenagers to adults — struggle with budgeting. To combat this problem, we developed a budget simulation that runs participants through many of life's everyday choices, from where to live to what kind of transportation to use. Each participant is given an envelope of Availa Buck$ (play money) to use toward their budget without going over. Once finished, participants may realize that they didn't quite make the right choices to meet their budget goals. They are then given a second chance to go through and change their answers so that they don't use all their Availa Buck$ on things they don't need.

-

Kickoff To College Nights

Preparing for college can be a confusing and intimidating time for students as well as parents. We discovered that many families struggle to figure out the financial components of college. Our Kick off to College nights are geared toward high school juniors and seniors and their families. We invite high school guidance counselors, local college representatives, and representatives from Iowa Student Loan (ISL) and Iowa College Access Network (ICAN). Attendees learn tips on filling out the FAFSA, the expected family contribution, scholarship opportunities, budgeting, student safety, college campus information, and more. Availa Bank is proud to have seven FAFSA-certified team members, several of which are present at each College Night to assist with any questions attendees may have.

Always Improving —

Employee Education

Ongoing education of our team members is critical to ensuring the success of Availa Bank, because the financial sector is full of change and growth. All our team members go through various annual training programs and have access to additional educational opportunities that allow them to expand their skillsets and industry knowledge. In this way, we foster a culture of professional improvement, excellence, and productivity.

- Ag Credit School

- IBA School of Banking

- BankSafe Training

- IBA Emerging Leaders

- Annual Trainings

Find out how you can be part of the Availa team!

Join our TeamBanking on success —

Awards & Recognition

At Availa Bank, each team member strives to create a great experience for our customers. The same efforts go toward the internal experience for team members. We have consistently gained recognition and awards for these efforts, from financial education to wellness to customer experience and more. We're proud to know we have the best team, setting benchmarks for hard work and professionalism in community banking.

- 2022 DSM People's Choice Gold award for Best Bank

- 2022 — Fort Dodge Market President Dave Flattery: Greater Fort Dodge Growth Alliance Catalyst Award

- 2022 — Fort Dodge branch voted Best Bank in Fort Dodge

- Iowa Bankers Mortgage Corporation (Alliance Channel) top lending partner for 2022 & 2023

- 2023 Healthiest State Initiative Small Workplace Winner

- ABA Foundation Community Commitment Awards 2023 Financial Education Honorable Mention

- 2 members of the Availa Bank staff were recognized in 2023 for the 50-year banker distinction by the Iowa Bankers Association: Bob Butcher & Thomas B. Gronstal. Both men started their banking careers in 1973.

- 2023 Best Bank — Fort Dodge

- 2023 Best Loan Service — Fort Dodge

- 2023 Best Loan Officer — Patty Larson, Fort Dodge

- 2023 Best Hometown Bank — Fort Dodge

- 2024 Siouxland Choice Awards Local Favorite “Best Home Mortgage” — Terry Mulder, Sioux City