Understanding Your Credit Score Doesn’t Have to Be Complicated

Let’s be honest, credit can be confusing. Between all the myths and mixed advice out there, it’s hard to know what’s true and what actually matters. But don’t worry, we’re here to help make sense of it.

So, what is a credit score?

Think of it as a snapshot of your financial trustworthiness. It’s a number between 300 and 850 that lenders use to decide how likely you are to repay money you borrow. Whether you’re buying a home, getting a new car, or even setting up utilities, your credit score plays a big role.

The higher your score, the more confident lenders feel about working with you. It can affect things like your interest rate, your credit card limit, or even how much you pay upfront for things like rent or a phone plan.

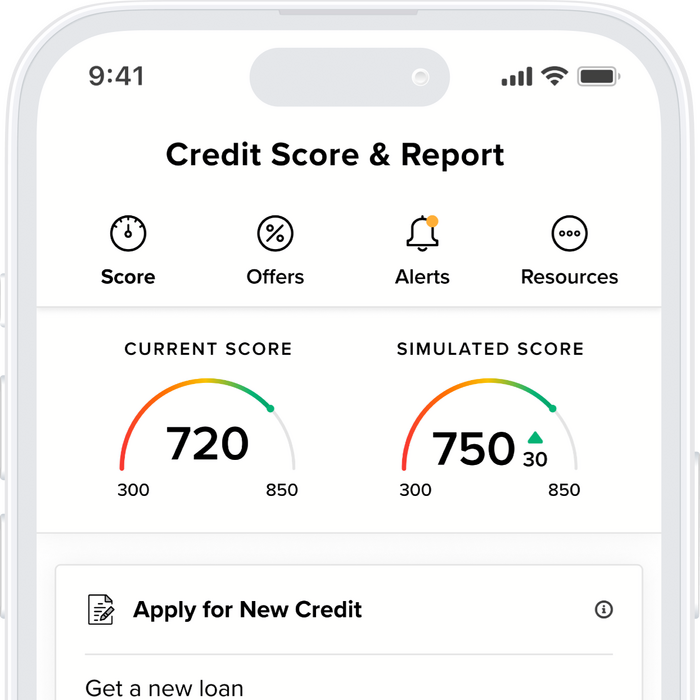

Credit Sense helps you understand your credit

You can check your credit score anytime—free of charge—through Credit Sense, available in online and mobile banking. It’s a simple way to stay informed and take control of your financial future.

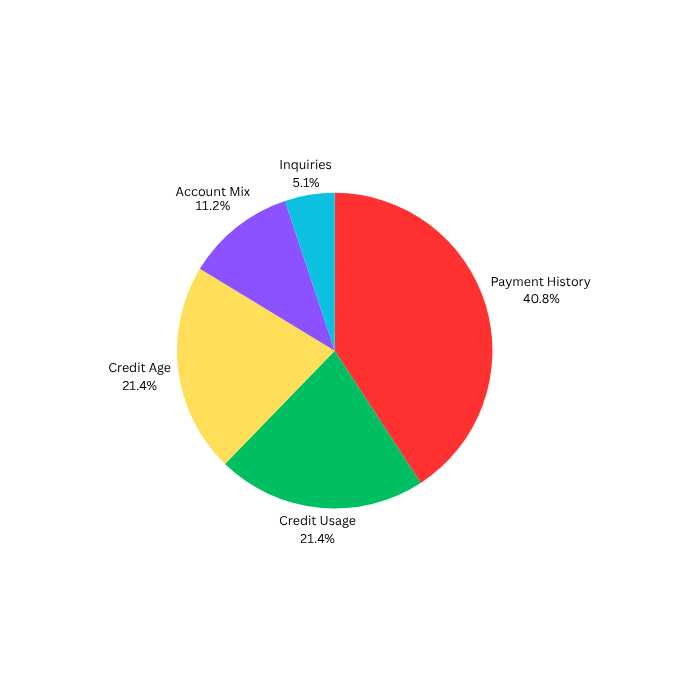

What really affects your credit score?

Five major factors will determine your credit score:

- Payment history (40%) – This is the biggest factor. Simply put, making your payments on time, every time, is one of the best ways to build a strong credit score. Even one missed or late payment can have a negative impact.

- Credit Usage (23%) – This refers to how much of your available credit you’re using. Experts recommend keeping your balances below 30% of your total credit limit. So, if you’ve got a $10,000 limit, try to keep your balance under $3,000.

- Credit Age (21%) – The longer your credit history, the better. Lenders like to see that you have experience managing credit over time. That’s why keeping older accounts open (even if you’re not using them much) can be a smart move.

- Account Mix (11%) – Having a variety of credit types, like credit cards, auto loans, or a mortgage, can help boost your score. It shows you can handle different types of borrowing responsibly.

- Inquiries (5%) – Every time you apply for new credit, a “hard inquiry” shows up on your report. A few inquiries here and there won’t hurt much, but applying for several new accounts in a short period can temporarily lower your score.

Credit Sense can help you track your credit score

If you’re enrolled in Credit Sense, you’ve got a helpful tool at your fingertips. Set up real-time alerts to track changes in your credit score and catch suspicious activity early. It’s a simple way to stay informed, protect your identity, and better understand how your financial decisions are shaping your credit health.

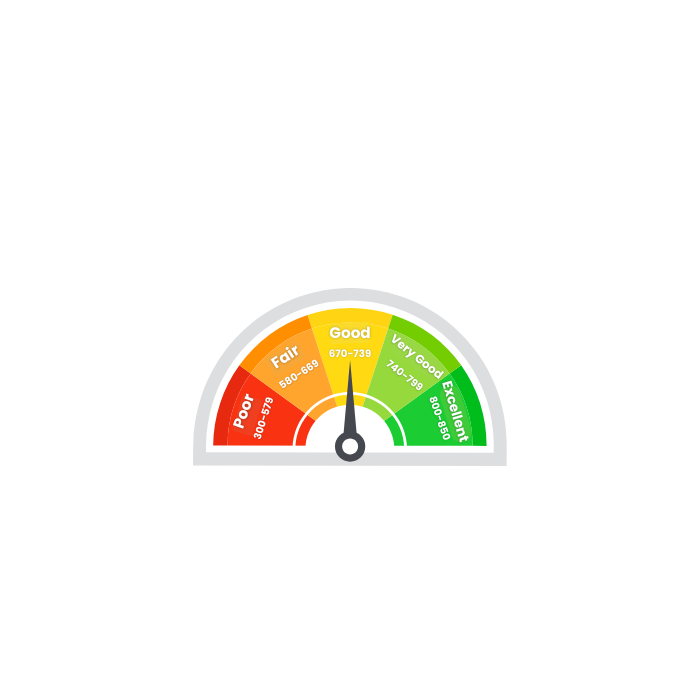

What’s a “good” credit score and what’s not?

Here’s a simple breakdown of what your score means:

- 800-850: Excellent – This is top-tier! Lenders see you as a low-risk, highly reliable borrower, someone they’re confident lending to.

- 740-799: Very Good – You’re well above average and considered a dependable borrower. This score can help you qualify for better rates and terms.

- 670-739: Good – This is a solid score. Most lenders will view you as a trustworthy borrower.

- 580-669: Fair – While this score is below average, many lenders still offer loans at this level, though likely at higher interest rates.

- 300-579: Poor – This score signals more risk to lenders, which can make getting approved for credit or loans more difficult. But don’t worry, it’s never too late to improve!

Your Credit Journey Starts With Credit Sense

No matter where you fall on the credit score scale, Credit Sense is here to help you grow and improve with confidence. You’ll have access to powerful tools and resources, including:

- Personalized goal settingto track your progress over time

- Acredit score simulatorto explore how different financial choices might affect your score

- A clear, customizedaction planto help address the specific factors holding your score back.

Plus, you’ll see personalized loan and credit offers based on your unique financial profile, making it easier to find the right fit for your financial goals.

Does Checking My Credit Score Lower It?

Nope, checking your own credit score does not lower it. In fact, keeping a close eye on your credit can actually help improve your score over time. When you regularly review your credit report, you’re able to spot changes, both positive and negative, as they happen. That means you can make smarter, more informed decisions moving forward.

With Credit Sense, you always have access to your full credit report. Your score is automatically updated every seven days, but if you’re eager for the latest information, you can manually refresh it once every 24 hours.

What about hard credit inquiries?

It’s important to understand the difference between a soft inquiry (like when you check your credit) and a hard inquiry (like when a lender checks your credit during a loan or credit card application).

Soft inquiries have no impact on your credit score. Hard inquiries, on the other hand, can cause a small, temporary dip in your score, usually just a few points. They stay on your report for about two years but usually only affect your score for the first year.

How Can Availa Bank Help Me With My Credit Future?

We’re here to support you as you build a stronger financial future, and that includes helping you take control of your credit.

With Credit Sense, you get access to a full suite of credit monitoring and improvement tools, all designed to give you a clearer picture of where you stand and where you can go. Once you’re enrolled, you’ll find everything from educational resources to a powerful credit score simulator, plus personalized loan and credit offers tailored to your unique needs, all in one convenient place.

Whether you’re just getting started or working toward a specific credit goal, we’re here for you every step of the way. And if you ever have questions or want to talk through your options, your local Availa banker is always ready to help!